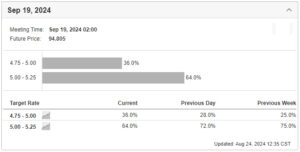

Odds of a 50-bps Cut in September by the US Fed Improve to 36%

Odds of a 50-bps cut in September by the US Federal Reserve improve to 36%

In the recently concluded Jackson Hole Symposium, which is an international conference hosted by the US Federal Reserve Bank of Kansas City attended by global central bankers, Fed Chairman Jerome Powell noted in a speech that “the time has come for policy to adjust.” His comments came as US headline CPI slowed for the fourth straight month to 2.9%, its lowest level since March 2021. Powell highlighted that “inflation has declined significantly” and that “the labor market is no longer overheated, and conditions are now less tight than those that prevailed before the pandemic. Supply constraints have normalized. And the balance of the risks to our two mandates has changed.” Recall that the US jobless rate unexpectedly rose to 4.3% in July, the highest since October 2021 and against market forecast that it would remain at 4.1%. With the economic data print in the last 4-5 months, Powell noted that the “direction of travel is clear and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.” Since Powell’s Jackson Hole speech, the odds of a 50-bps cut in September has improved to 36%. Previously, the probability of a 50-bps cut was at 28% while a 25-bps cut was at 72%. Between today and the Fed monetary policy decision on September 19, the key data that will be on deck are the latest PCE inflation reading, non-farm employment change and jobless rate, and CPI report.

Source: Investing.com

_____

To know more about the Trading Edge Equity Advisor, kindly click HERE. Subscribe now to receive email alerts before the price moves! Here’s what our students and subscribers say. 🙂

*Consensus target price or average target price given by the major foreign and local brokers of various stocks on top of index names are available in our Equity Advisor!