Divergence of Monetary Policies Between BSP and Fed Weighing on Local Assets

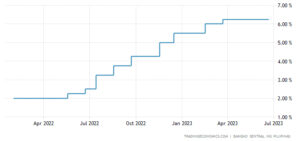

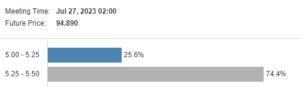

The Bangko Sentral ng Pilipinas kept its benchmark interest rate unchanged at 6.25% for a second straight time, as expected. Interest rates on overnight deposit and lending facilities were also kept at 5.75% and 6.75%, respectively. The central bank’s decision came as domestic inflation eased further to 6.1% in May from 6.6% in the prior month. However, diverging monetary policies between the US and the Philippines, especially with the former seen to raise by another 25 bps in July, may continue to weigh heavily on the Peso and on the local stocks. At present, the interest rate differential between the US and the Philippines stands at 100 bps. This is seen to narrow further to 75 bps should the Fed continue to hike next month. This lack of premium of Philippines sovereign assets relative to the US is one of the main reasons that continue to discourage foreign inflows in the country.

*BSP benchmark interest rate

*probability of Fed funds rate in July 2023

_____

To know more about the Trading Edge Equity Advisor, kindly click HERE. Subscribe now to receive email alerts before the price moves! Here’s what our students and subscribers say. 🙂

*Consensus target price or average target price given by the major foreign and local brokers of various stocks on top of index names are available in our Equity Advisor!