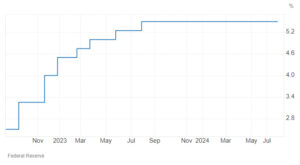

Fed Keeps Its Interest Rate Unchanged at 5.5%; Cuts Now on the Table

The Fed kept its interest rate unchanged at a target range of 5.25% to 5.5%, as widely expected. Fed Chairman Jerome Powell noted the improvements in inflation over the last several months and with that, a policy rate reduction could be on the table as soon as the Fed’s next meeting on September. In his post decision interview, he said that “rates have been restrictive for a year and that the time is coming to be appropriate to dial back the level of restriction so that we may address both mandates (inflation and employment).” The unexpected rise in recent unemployment claims to 249k (versus 236k consensus) and the surprise decline in ISM manufacturing PMI to 46.8 from 48.5 which further indicates that the US manufacturing sector could already be contracting have upped the possibility of more cuts. Moreover, the less-than-expected non-farm employment change of only 114k in June (versus 176k forecast) from 179k added in the prior month alongside an unexpected rise in jobless rate to 4.3 percent (versus 4.1 percent consensus) from 4.1 percent have stoked fears that the Fed may have waited for too long. For the remainder of the year, the futures market is now pricing in a 100 percent likelihood that the Fed will cut its rates by AT LEAST 75 bps, up from an earlier guidance of just 50 bps.

Source: Trading Economics

_____

To know more about the Trading Edge Equity Advisor, kindly click HERE. Subscribe now to receive email alerts before the price moves! Here’s what our students and subscribers say. 🙂

*Consensus target price or average target price given by the major foreign and local brokers of various stocks on top of index names are available in our Equity Advisor!