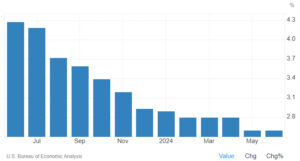

US Core PCE at 2.6 Percent in June

The US core PCE, which is the Fed’s preferred inflation measure, remained at 2.6 percent in June, higher than the 2.5 percent consensus. While the core PCE steadied, it was nonetheless the lowest tally since it jumped to 5.757 percent in February 2022. Meanwhile, the headline PCE slowed to 2.5% in June from 2.6% in May, in line with market forecast. With the core PCE continuing to slow below the 3% level since the start of the year, it is now highly likely that the Fed will start to cut its rate in September. In fact, the futures market is now pricing in a 100 percent likelihood of a 25 basis point cut in September. On top of that, there is also a 68.2 percent probability of an additional 25 bps cut in November and a 64.1 percent probability of another 25 bps cut in December.

Source: Trading Economics

_____

To know more about the Trading Edge Equity Advisor, kindly click HERE. Subscribe now to receive email alerts before the price moves! Here’s what our students and subscribers say. 🙂

*Consensus target price or average target price given by the major foreign and local brokers of various stocks on top of index names are available in our Equity Advisor!