US Long Term Treasury Yields Seen to Fall Further; Boost Flows to Equities

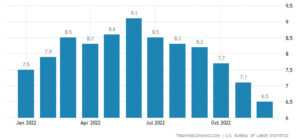

US headline inflation, as measured in the CPI, cooled to 6.5% in December 2022, in line with market consensus, from 7.1% in November. This marked a sixth straight months of decline after it reached a 40-year high of 9.1% in June. For the year, inflation had averaged 8.02% which was way above the Fed’s 2-4% target range. With the continued slip in the price of a basket of goods and services, though, the Fed is now expected to increase its interest rates by only 100 basis points for 2023 (compared to the 425 basis point hike that it did in 2022).

As a result of the improvement in the CPI in the last several months and more recently of the producer price index (PPI), which measures the change in the price of finished goods and services sold by producers, declining by 0.50% in December 2022 (versus expectations of an 0.20% increase), long term yields in the US have continued to taper. Since reaching a 15-year high of 4.333% in October 2022 on the back of the aggressive interest rate hikes by the US Federal Reserve, the 10-year treasury yield have cooled back to 3.376%. And with the Fed seen to have a less tight monetary policy in the present year, it appears that long term yields will further come down, thus, boosting flows to riskier assets like equities, more specifically emerging markets like the Philippines.

From a technical standpoint, one can see that the surge in the US 10-year treasury yields (TNX) was actually followed by pivot off a very notable cup and handle base at the start of 2022. Recently, though, TNX has just broken below the pivot handle of a failure swing top. This break, if sustained, may then transition it to a fresh bear leg. With the above prognosis, it seems that both fundamental and technical factors favor a possible decline in yields over the next several months and as a result favor a consequent rise in the global stock market.

_____

To know more about the Trading Edge Equity Advisor, kindly click HERE. Subscribe now to receive email alerts before the price moves! Here’s what our students and subscribers say. 🙂

*Consensus target price or average target price given by the major foreign and local brokers of various stocks on top of index names are available in our Equity Advisor!