Ayala Land Craters on Thinking Pinoy “Research”

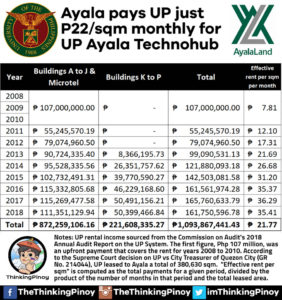

Ayala Land, Inc. (ALI), the property arm of Ayala Corporation (AC), sunk by 7% to a fresh 52-week low of Php40.50 on news that the Palace is set to probe the U.P. Ayala Land TechnoHub project. In a speech, Presidential Spokesperson Salvador Panelo said “I have to probe it. I read it in the internet that ‘yun pa lang Technohub diyan sa UP run by the Ayalas, parang maraming maraming ginawang computation ‘yung nag-research.” He added, “Parang lumalabas na ‘yung buong lugar na ‘yun is being rented by the Ayalas at less than P20 per square meter for 25 years. Eh kung totoo ‘yun eh ‘di malaki na naman ang problema.” Apparently, what prompted him to look into the matter was a social media post by a blogger named RJ Nieto a.k.a. Thinking Pinoy last Saturday, January 18, 2020 as seen below.

Given the possibility that Ayala Land may be strong armed to revise its deal with the state-owned University of the Philippines, investors were obviously warranted to heavily sell the stock along side its parent company, Ayala Corporation.

From a technical perspective, ALI is actually seen to extend its decline given its break from a confluence of key supports namely its 3-year uptrend line, support of a descending channel, and its prior swing low at Php42.55 on heavy volume. Having said that, the stock may then fall towards its next support at the Php36.00 to Php38.00 zone. Note that ALI must rally above Php42.55 to nullify the said breakdown. Still, its ongoing fall may be taken by long term investors as a window to go long on the stock (in tranches) since it is already trading at a steep discount versus its 12-month consensus fundamental target of Php56.95. Admittedly, though, there’s a likelihood that analysts may revise lower their estimates on the stock given the ongoing regulatory uncertainty.

ALI write-up from the Trading Edge Equity Advisor:

January 16, 2020

Ayala Land, Inc. (ALI), while it is trading right at its support at its November 2019 low of Php42.55, is actually in danger of falling further. You see, the lower highs that it has established since July 2019 place a lot of downside pressure on the said support. Note that a break below Php42.55 may then send it to its next support at Php38.00. Still, any weakness on the stock may be taken by long term investors as a window to pick it up in tranches as it is already trading at a good discount versus its 12-month consensus fundamental target of Php56.95.

_____

To know more about the Trading Edge Equity Advisor, kindly click HERE. Subscribe now to receive email alerts before the price moves! Here’s what our students and subscribers say. 🙂

*Consensus target price or average target price given by the major foreign and local brokers of various stocks on top of index names are available in our Equity Advisor!