Trading Edge Equity Advisor also has Quick Trades!

ACR write-up from the Trading Edge Equity Advisor:

February 13, 2013

Alsons Consolidated Resources (ACR) may recover some of its gains that it lost recently. As you can see from the chart, ACR in 1 swift move jumped from just above Php1.30 to close at Php1.43. In the process of doing so, it also broke the significant resistance at Php1.40. The next day, demand continued to be high as the stock jumped once again and even made a bullish gap to mark a high of Php1.59. A lot of sellers, however, took the opportunity to cash in, pushing ACR back to Php1.50 and in the process forming a bearish shooting star candle. Sentiment on the third day switched to bearish mode as sellers poured in to immediately close its recent gap. The sentiment on the stock however has improved somewhat as it finds support at the Php1.40 marker. Given that, ACR may bounce again from its present level to around Php1.50.

Buy at present level or closer to Php1.40

Target at Php1.50

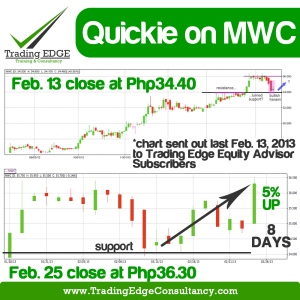

MWC write-up from the Trading Edge Equity Advisor:

February 13, 2013

Here’s another quick trade idea seen in Manila Water Company, Inc. (MWC). MWC has gradually risen from around Php27.00 back in October 2012 to just above Php36.00 during the last week of January 2013. Although before it moved towards Php36.00, it first stationed below Php34.00. At present, MWC has retraced back to Php34.00. Seeing this level as a previous resistance, MWC now could treat it as a support which could push it back to around Php36.00. Moreover, a bullish harami candles have formed during the last two days indicating that MWC would likely rally soon.

Buy at present level or closer to Php34.00

Target at Php36.00

_____

To know more about the Trading Edge Equity Advisor, [zenith_button text=”Click Here” url=”http://tradingedgeconsultancy.com/services/subscription/” target=”_self” size=”btn-medium” style=”rounded” color=”#1b9772″]

Subscribe now to receive email alerts before the price moves!